Bridgewater at Mt. Zion

3156 Mt. Zion Road, Stockbridge

Atlanta, Georgia

33.555395 | -84.287342

The partnership with ICG offers REALIANCE relations the opportunity to participate in a proposition, which a defensive risk profile with an immediately distributable cash flow. The current occupancy rate of 95% offers a solid basis for an annual distribution of 9% from the start and also to build up a cash reserve. Although the strategy is to sell the complex after approximately five years, a 10-year fixed-rate loan offers the opportunity to choose a good sales moment in the cycle. Assuming a conservative cap rate of 7% on sale, a projected return of 90.3% is expected over a five-year term.

The placement of the required equity amounts US$ 3.5 million for direct participation in an American Limited Partnership. The participation size is US$ 25,000 with a minimum purchase of five participations. ICG and REALIANCE will jointly contribute US$ 559,500 (13.8%) of equity.

Key data

Project name

Bridgewater at Mt. Zion

Location

3156 Mt. Zion Road, Stockbridge Atlanta, Georgia, USA

Initiator

REALIANCE USA B.V.

Local partner

InterCapital Group (ICG)

Property Manager

Vesta Property Management

Category

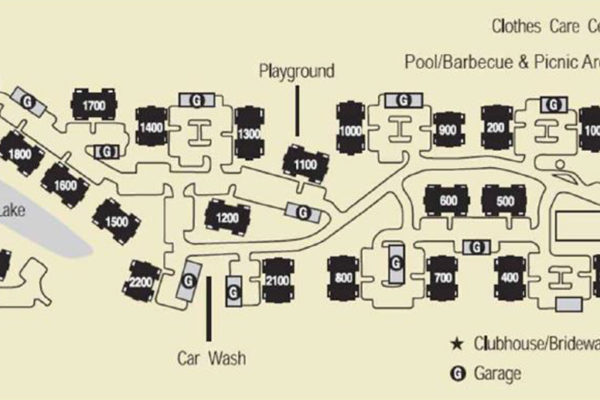

200 Rental apartments

Expected investment term

Five years

Exit strategy

Sale to investor

Participation

From US$ 125,000 excl. 3% emission costs (140 participations of US$ 25,000)

Structure

Direct participation in Bridgewater at Mt. Zion LP

Equity

– Dutch and German investors US$ 3,500,000

– ICG and REALIANCE US$ 559,500

Direct distribution per quarter

9% per year

Projected gross total return

90.3% after five years

Projected gross return (ROI)

18.1% per year

Unique selling points

Atlanta, the unofficial capital of the Southeast, is one of the most dynamic regions in the US and has a favorable business climate for companies and a pleasant living environment for its (highly educated) residents.

Atlanta is a quintessential Southern American city with strong population and employment growth resulting in a high demand for rental apartments.

Great location on Mount Zion Road, convenient to employment centers around Hartsfield-Jackson International Airport and Henry County Once/ Industrial District.

Local partner is very experienced as an investor and property manager with similar projects in the south of the US with Atlanta as one of its most important markets.

Defensive risk profile reinforced by a 10-year fixed-rate financing, so that there is no refinancing risk during the term.

Low interest rate and a high occupancy rate of 95% ensure on a cash-on-cash return of 9% on an annual basis, whereby also a cash reserve can be built up.

ICG and REALIANCE have a substantial share in the required capital.

Location

For more information you can reach REALIANCE at +31 (0) 20 21 03 180 or invest@realiance.nl